How New Healthcare Laws Are Shaping Elder Care in the U.S.

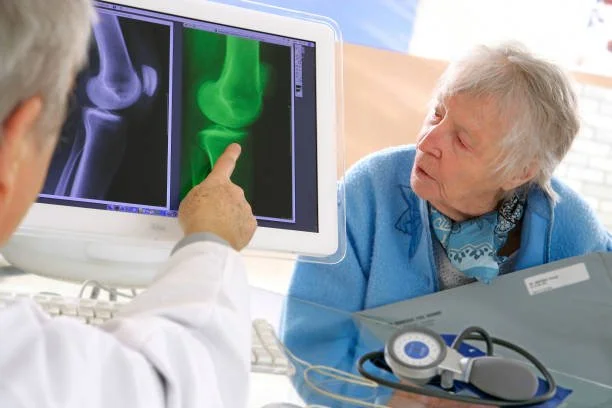

As sweeping healthcare reforms move forward, the elderly population faces mounting challenges—from reduced Medicaid retroactive coverage to more frequent eligibility renewals. Learn how these changes increase legal risks in elder care and how medical-legal professionals can respond.

1. Medicaid Retroactive Coverage Cuts: A Costly Shift for Seniors

Starting in 2027, Medicaid retroactive coverage will be reduced from three months to two months—a change that is especially burdensome for older adults who are hospitalized prior to applying for benefits, often through no fault of their own. This reduction could result in thousands of dollars in unexpected medical debt for seniors, particularly those needing nursing home care.

2. Eligibility Redeterminations: More Hassle, Less Security

Broader budget reconciliation bills are enabling states to increase the frequency of eligibility reviews, moving from annual to potentially semi-annual renewals. This introduces administrative risk and could lead to short-term coverage lapses among seniors—especially those in the “near-elderly” demographic.

3. Medicaid and Marketplace Cuts: Lower Access, Higher Stakes

The 2025 reconciliation law, sometimes referred to as the One Big Beautiful Bill (OBBBA), includes significant cuts to Medicaid and the ACA Marketplaces. Policy analysts estimate as many as 15 million Americans—notably older adults—could lose coverage over the next decade due to these cuts. Changes include more eligibility red tape, work requirements, limits on tax credits, and reductions in funding for long-term services.

4. Impact on Elder Care Infrastructure

Long-term care providers—including nursing homes that rely heavily on Medicaid—are expected to feel the impact strongly. Underfunded services and staffing shortages (seen in recent exposés) suggest that affordability and access for elderly patients may deteriorate further.

Best Practices: Shielding Seniors Amid Shifting Healthcare Laws

| Strategy | Why It Matters |

|---|---|

| Advance-Care Planning | Proactively establishing directives protects care in emergencies and funding gaps. |

| Early Medicaid Enrollment Counseling | Prevents coverage loss and retroactive gap exposure for recently hospitalized seniors. |

| Monitor Policy Changes Closely | Stay ahead of eligibility shifts to prevent abrupt coverage interruptions. |

| Advocate in Court or Agencies | Defend seniors’ benefits when documentation or bureaucracy jeopardize access. |

| Partner with Provider Networks | Coordinated support helps maintain care continuity when policy shocks occur. |

Bottom Line: Elder Care Is at Legal Risk—And Needs Preemptive Protection

As the legislative landscape intensifies—with eligibility barriers rising and coverage shrinking—older Americans are uniquely vulnerable. Lexcura Summit Medical-Legal Consulting provides healthcare providers and attorneys with strategic, compassionate guidance to safeguard access to elder care, defend against legal disputes, and ensure compliance during this uncertain era.